How does Apple, the #1 innovative company in the world, innovate and create game-changing innovations such as the iPod, iTunes, iPhone, iPad and more? What is Apple's secret recipe for innovation success?

What is Apple's Innovation Strategy and Innovation Process? Attend this engaging workshop delivered by Sanjay Dalal, chief innovator of InnovationMain and author of Apple's Innovation Strategy. Get detailed information, innovation insights, case study and report, and learn to innovate like Apple... and think like Steve Jobs, the top innovator and CEO of Apple.

"There's an old Wayne Gretzky quote

that I love. 'I skate to where the puck

is going to be, not where it has been.'

And we've always tried to do that at

Apple. Since the very very beginning.

And we always will." — Steve Jobs, Apple CEO

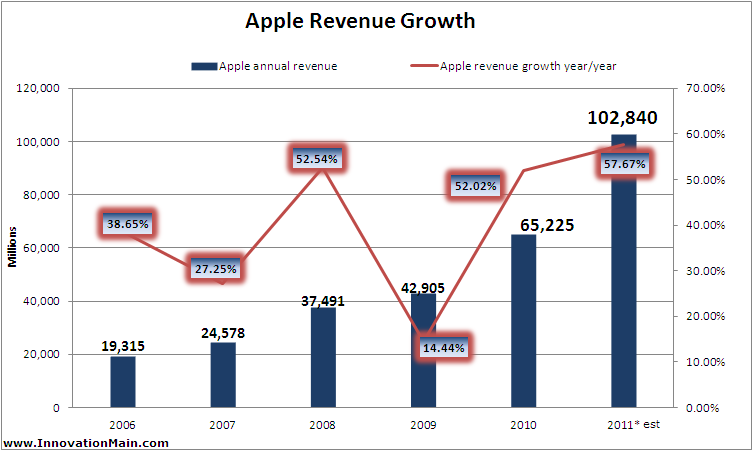

Apple Revenue Growth is spectacular! Since 2000, Apple sales has grown 1,200%, profits have skyrocketed 3,000% and maket cap has exploded more than thirty times to over $300 billion.

Apple innovates through:

• Creativity and Innovation

• Innovation Process

• Innovation in Products

• Innovation in Business Model

• Innovation in Customer Experience

• Innovation and Leadership

• Steve Jobs Leadership

This Apple Innovation Strategy seminar uses the latest Apple Innovation eBook that provides key insights, strategy, best practices, process, facts, Steve Jobs interview, and much more... Apple's Innovation Strategy eBook forms the basis of this workshop!

Apple has built an Innovation Factory – one that harnesses unbridled creativity from its people, stimulating bold & enterprising new ideas, and launching successful, profitable new innovations... time and again! Apple leverages its diverse ecosystem of employees, customers, suppliers, partners & global networks, proven innovation process, and a winning culture to seize new opportunities in the marketplace and grow its business... exponentially!

Key Benefits of Training Seminar

1. Learn how Apple and Steve Jobs innovate, and made Apple #1 innovator

2. Expand your creativity, and learn how to think different and generate new ideas

3. Create and architect process to make successful, innovative new products and services

4. Make innovation a key differentiator, and sustainable competitive advantage for your business

Workshop Schedule

Online Weekly Event - Every Wednesday: 1:00 PM to 2:30 PM (PT)

REGISTER NOW!

Learn to Innovate like Apple! Now!

Hosted by

InnovationMain - Creativity and Innovation Driving Business provides uncommon insights, strategy and solutions with proven processes that drive Creativity and Innovation at your business, create real market growth and success for your products and services, and achieve market leadership. We make innovation a sustainable competitive advantage, inspire you to build an innovation factory, effect and manage change, and accelerate your business. We have considerable experience and expertise in working with small, growing and established companies, product and marketing departments, and innovation teams. InnovationMain - Creativity and Innovation Driving Business is an Irvine Chamber of Commerce Member in Orange County, California.

About Sanjay Dalal, chief innovator

Sanjay Dalal is an Innovation Author & Consultant, Innovation & Marketing Speaker, Innovator and Community Leader. Sanjay is the author of the leading Business Innovation eBook & Resource Kit used by over 1,000 innovators worldwide including Nokia, Pepsi, HP, LG, J&J, TATA, SAP, major universities...and is the author of the all new Apple's Innovation Strategy. Learn more about Sanjay Dalal here

Web: www.InnovationMain.com

Phone: 1-949-288-6880

Address: 111 Academy Way, Suite 100, Irvine, CA 92617